Image courtesy of Yahoo! Finance

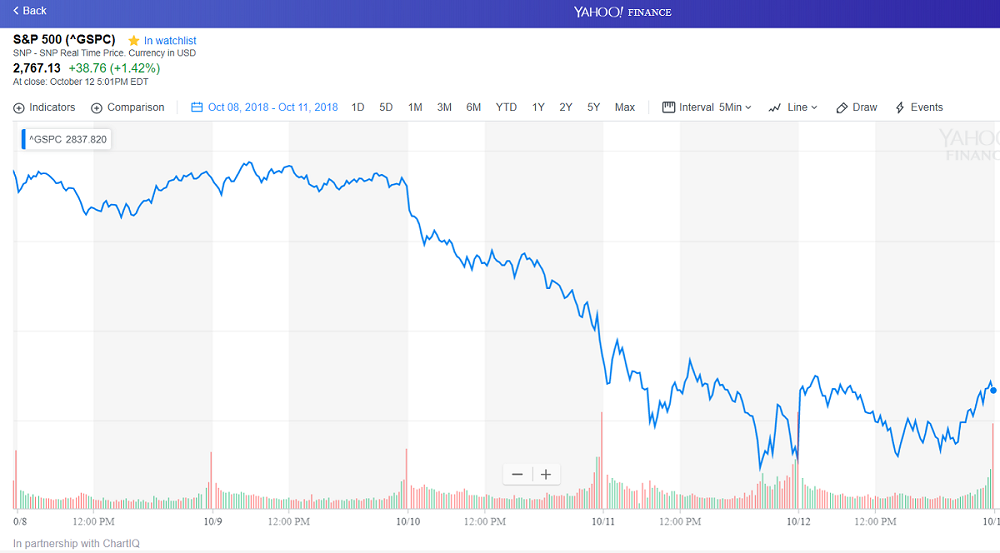

Despite the market’s gains on Friday, last week was a tough one for investors. On Wednesday, the S&P 500 fell 3.3%. It dropped another 2.1% on Thursday, extending its string of losses to seven straight days. Even with Friday’s 1.1% rise, U.S. stocks delivered their worst week since March.

Wednesday’s decline was also the worst single-day fall since February 8th when stocks closed 3.8% lower. The two-day decrease was not our worst of the year. It lagged the back-to-back losses experienced on February 2nd and 5th. Historically, the market falls more than 3% in a single day every three-to-six months. So, a drop like Wednesday’s should be expected two-to-three times a year – just what we are experiencing so far in 2018.

Before Wednesday, it had been 74 days since the S&P 500 closed up (or down) by 1% or more. It had been 129 days since the last time there was a move of at least 2%. Based on these factors, market activity in 2018 remains on pace to be less volatile than it was in 2015 or 2016.

Down Days Vs. Up Days for the Financial Markets

Down days can be more impactful than up days for a few reasons:

· Typically, the pain associated with losses is greater than the good feelings that accompany gains.

· The financial news – whether in print or on television does not help. If you listened to your favorite financial news network on Wednesday, you likely would have heard people screaming: the Dow is down 800 points! That can certainly be nerve-wracking.

· You may not have a plan in place or processes that you regularly follow when you put your portfolio together. This can make you even more concerned when the market becomes more volatile.

Keeping Losses in Perspective

It is important to keep the losses in context, too. The markets have climbed considerably over the last decade. Movements that were once considered exceptional on an absolute basis are not nearly as meaningful on a percentage basis.

For example, many commentators refer to the Dow’s 508-point fall in October 1987 – a day that has come to be known as Black Monday. At the time, it seemed an earth-shattering event as it represented a single-day decline of nearly 23%. While Wednesday’s fall was larger on a total points basis, since the Dow is above 25,000 today, it translates into roughly a 3% drop.

U.S. markets also remain up for the year, so this week’s losses did not erase all the year-to-date gains either.

Why Did the Market Fall?

While we typically see numerous explanations for the market’s decline, the truth is the fall rarely has a catalyst. The same rationale applies when the market rises. Sometimes stocks drop because they have gone up too quickly. Other times they increase because they fell too much before they moved higher. Investors might even simply be looking for an excuse to make a change.

In this case, we cannot dismiss the fact that the market had done so well for so long that some sort of backlash was inevitable.

However, there are risks in the market currently. Perhaps more so than normal.

For example:

· We are already experiencing the longest bull market in history.

· On Tuesday, the International Monetary Fund downgraded its outlook for the world economy.

· Hurricane Michael made landfall in Florida on Wednesday as one of the worst US hurricanes on record.

· The trade war with China is escalating and neither side seems willing to back down.

· Sears, once America’s most iconic retailer, is reportedly on the verge of filing for bankruptcy.

· While U.S. economic growth remains solid, we are late in the economic cycle. This can lead to heightened market volatility and more uneven performance.

Rising interest rates are another factor to consider. For some time, the low-rate environment had investors saying there was no alternative to stocks. Short-term interest rates have been rising steadily since 2015, when the Fed raised interest rates for the first time since July 2006. Late last year, the yield on the two-year Treasury note edged higher than the S&P 500’s dividend yield for the first time in nearly a decade. As a result, holding those government bonds provided more income than holding stocks – and with less risk of prices depreciating. As the two-year yield continued to increase, the bonds became increasingly attractive, particularly for risk-averse investors.

If I could say with any certainty why the market reacted the way it did last week, I would. Unfortunately, I cannot. Nobody else can either. We like to assume there is an identifiable cause when the market moves sharply in either direction. However, that is not the way financial markets work. A lot of different things happen all at once, in real time, and markets react.

Thoughts on How to React

We do not even know if this is the beginning of a correction, or even worse a bear market. In February there was great concern when the market experienced the biggest single-day point decline in its history. A few months later, the market closed at a new all-time high.

While the bears may be easily startled and fearmongering appears to be on the rise, it is important to stick to your process and maintain a long-term focus. When thinking about the decline, it can help to keep the following ideas in mind:

1. Remain calm. Don’t panic.

2. Expect more declines.

3. Stay patient.

When thinking about your existing portfolio, you might also consider taking the following steps:

1. Review your portfolio and assess the extent of the market volatility’s impact. If you are well diversified, the effect may not have been as bad as what you see in the headlines.

2. Check your asset allocation. Consider re-balancing if the weights are too far from target levels.

3. Check for opportunities. Is there anything on your wish list that you would like to buy. Perhaps your favorite stock, exchange-traded fund (ETF), or mutual fund went down more than the market.

The key is to avoid getting caught up in the media hype. Stick to your plan, review your portfolio, and make any needed adjustments that are in accordance with your investment plan and process.

While others panic, you may be best served if you can simply remain calm. Let the others do the worrying for you. Remember that investing is a long-term game.

The Short Term vs. the Long Term

Markets go up. Markets go down.

Historically, markets bounce back from adversity. We just don’t know how long it will take for that to happen. Wise investors who recall previous declines can use them to their benefit now.

However, maintaining a focus on the long term does not mean the short term can be ignored. After all, the long term is essentially a group of short-term events that needs to be managed. One of the biggest advantages of maintaining a long-term focus is you can benefit from a compounding effect others who quit before you miss out on. However, that approach only works if you are cognizant of, prepared for, and willing to manage short-term events.

Being able to make long time horizons work means your asset allocation, cash flow, and mindset are purposely designed to handle the noise that occurs within short time horizons. In many ways, the process you follow is much more important than the actual results. A good, repeatable process greatly increases your chances of achieving the best possible outcome in an uncertain environment.

It is also important to remember the impact of a long-term time horizon. On a daily, monthly, or even yearly basis, the stock market can be highly volatile. Over longer periods, the chances of positive returns grow significantly.

Maintaining enough liquidity is also important. Make sure your shorter-term cash flow needs are covered. If these needs are met, your ability to tolerate downside volatility increases. When constructing client portfolios at Apprise Wealth Management, we consider maintaining one-to-three years of liquidity on hand. This helps limit your need to sell low to raise cash.

Realizing that looking at your portfolio on a regular basis is not going to change what happens to it can also help. If you look less frequently, volatility’s effect should dissipate. If you own your personal residence, you probably don’t look its value up on Zillow all that frequently. If you are comfortable with how you have invested and the plan you are following, you should not need to look at your portfolio all that often either.

If the market’s recent volatility makes you nervous, perhaps you are taking on too much risk. On the other hand, if you were not nervous, you might be able to take on a little more risk.

Are you prepared for the risks that come with investing?

Nothing said in this blog is meant to scare you. It is, however, important to make sure you have a plan!

A plan helps you to be prepared for these risks.

When you have a plan, seeing “Dow down 800” doesn’t hurt quite as much.

When you invest for the long term and prepare for risk, you should sleep a lot better at night.

When you plan for your financial future you have comfort knowing you are taking steps to live the retirement of your dreams.

If you do not have a plan or are not comfortable with your plan – Apprise can help!

If you lack the Knowledge, Interest, and/or Time (collectively, “KIT”) to manage these issues on your own, please fill out our contact form, and we will be in touch.

We want to help you succeed in retirement and rest easy.

Follow us:

Please note that we post information about articles we think can help you make better decisions about money on Twitter.

For firm disclosures, see here: https://apprisewealth.com/disclosures/