I don’t usually write about day-to-day market moves. Short-term fluctuations rarely matter when your financial plan is built to support your long-term goals. I shared some thoughts about the current market conditions only three weeks ago. Even though the S&P 500 fell 4.8% on April 3rd and 6% on April 4th, I started last week with no intent to write about the market again. Talking about the market too much, especially when you rarely discuss it at all, can do more harm than good.

But after the sharp drops on April 3rd and 4th—followed by the unusual market activity on Tuesday, April 8th—I felt it was worth a quick check-in. On Wednesday, I sent an email to clients about the market. I was simply going to share that email as this week’s blog, but more needs to be said.

Wednesday, April 9

The day started out uneventfully. I was making routine purchases for client portfolios—nothing out of the ordinary. By mid-afternoon, the market had surged higher, fueled by news of a tariff pause. Stocks I had purchased earlier in the day were suddenly up as much as 15–20%. These were companies from different sectors, not the type of movement you’d expect without something like a positive earnings surprise, major news impacting the company, or an acquisition. Was it insight? Hardly—just good timing. And a reminder that market moves often defy prediction.

I’m not sharing this to say that I had any special insight into what was happening. I chalk it up to fortunate timing rather than great foresight. Fortunately, I completed my purchases before the market took off. I am happy to have a long-term time horizon for my stock purchases. In this case, the market’s volatility created what I perceived as a buying opportunity. Only time will tell whether purchasing the individual stocks I bought for clients was the right thing to do.

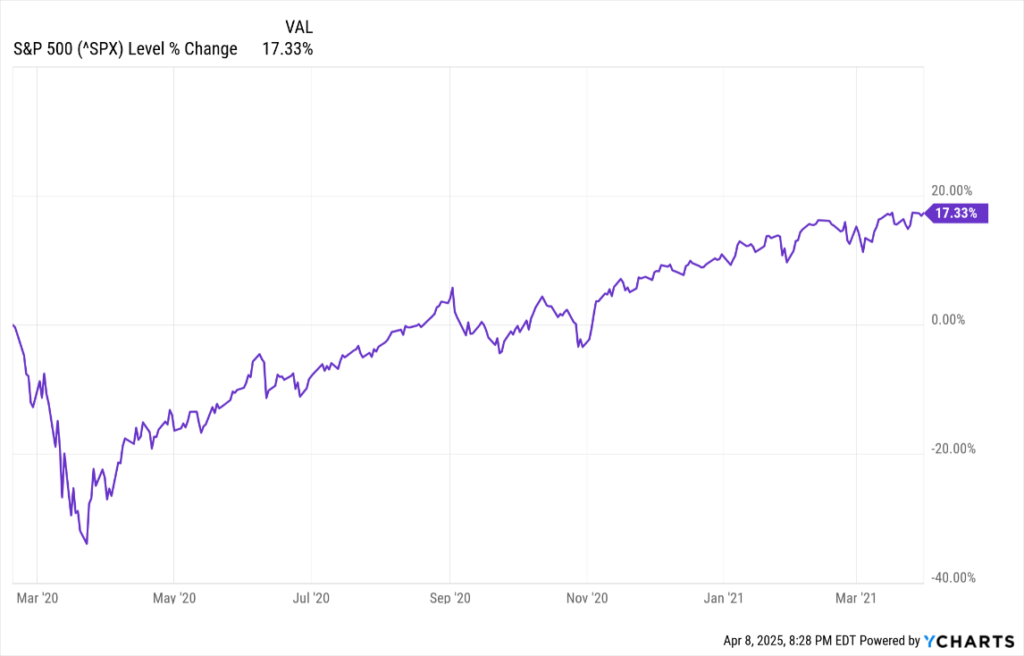

The above chart shows how the S&P 500 performed on Wednesday. The 9.5% gain on April 9th was the eighth-largest single-day percentage gain in S&P 500 history. It also represented the largest single-day points gain ever.

The S&P 500 ended the week up 5.7%, its largest weekly gain since the week ending November 3, 2023. I looked at other strong weekly returns for the S&P 500 over the last few years. In those cases, the Index rose at least four of five days for the week. This past week, the Index fell three out of the five days.

At this point, it’s quite difficult to find the words to describe the stock market’s activity over the last 10 days. The Trade War has left capital markets across the globe a bit unsettled, if not upset. It’s a powerful reminder of the importance of staying focused on the long term and remembering: This Too Shall Pass.

With that backdrop in mind, I’d like to share the letter I sent to clients last Wednesday. I hope it helps you feel more grounded—and more confident—in your plan.

Here’s What I Shared With Clients Early on Wednesday, April 9th

Dear Client,

I hope this note finds you well—and not spending too much time worrying about your portfolio.

The last few days in the market have been bumpy. After a brief rally on Monday amid news that tariffs might be eased, the market, as measured by the S&P 500, closed with a modest loss. Tuesday opened strong, with the S&P up as much as 4% in the morning amid optimism about trade negotiations. However, sentiment shifted, and the S&P 500 closed down 1.6%. The Nasdaq followed a similar path—up 4.6% early in the day but finishing 2.2% lower. According to the Wall Street Journal, these results represented the largest “blown gains” for these indexes since 1978 and 1982, respectively. This week’s volatility followed consecutive declines in the S&P 500—down 4.8% on Thursday, April 3rd, and 6.0% on Friday, April 4th.

As investors, we grow accustomed to bouts of volatility. Still, swings like these can be unsettling, even for seasoned investors. If you have been feeling anxious, you are not alone.

Periods of uncertainty are part of investing. But that doesn’t make them easy. When the market fluctuates sharply, it’s natural to feel the urge to “do something.” Most of the time, though, reacting in the moment is a mistake.

Let me share a quick story. When I was an energy analyst, reporters often asked me for my oil price forecast. I’d tell them:

“Forecasting oil prices is part of my job. But I can’t predict geopolitical surprises or how oil-producing nations will act. The regular laws of supply and demand often don’t apply to the oil market either. I’m going to give you a number—but the one price I can almost guarantee you it won’t be… is the one I’m about to give you.”

Over seven years, I hit it on the nose once. And that was luck.

It’s a good reminder: no one can reliably predict short-term market moves. Not me, not the media, not economists or market experts.

If recent headlines have made you uneasy, I understand. But this is exactly when it’s most important to stay focused on the long term and remember, “This Too Shall Pass.” (See also the original version.)

Your financial plan and your portfolio were built with long-term goals in mind—not short-term noise. The headlines are loud—but they shouldn’t change your goals… or your plan.

So what can we do?

We focus on what we can control:

- Stay diversified. At least so far, diversified portfolios have generally held up better than the broader market. Bonds values have risen as interest rates have declined. International stocks have, in many cases, outperformed their U.S. counterparts.

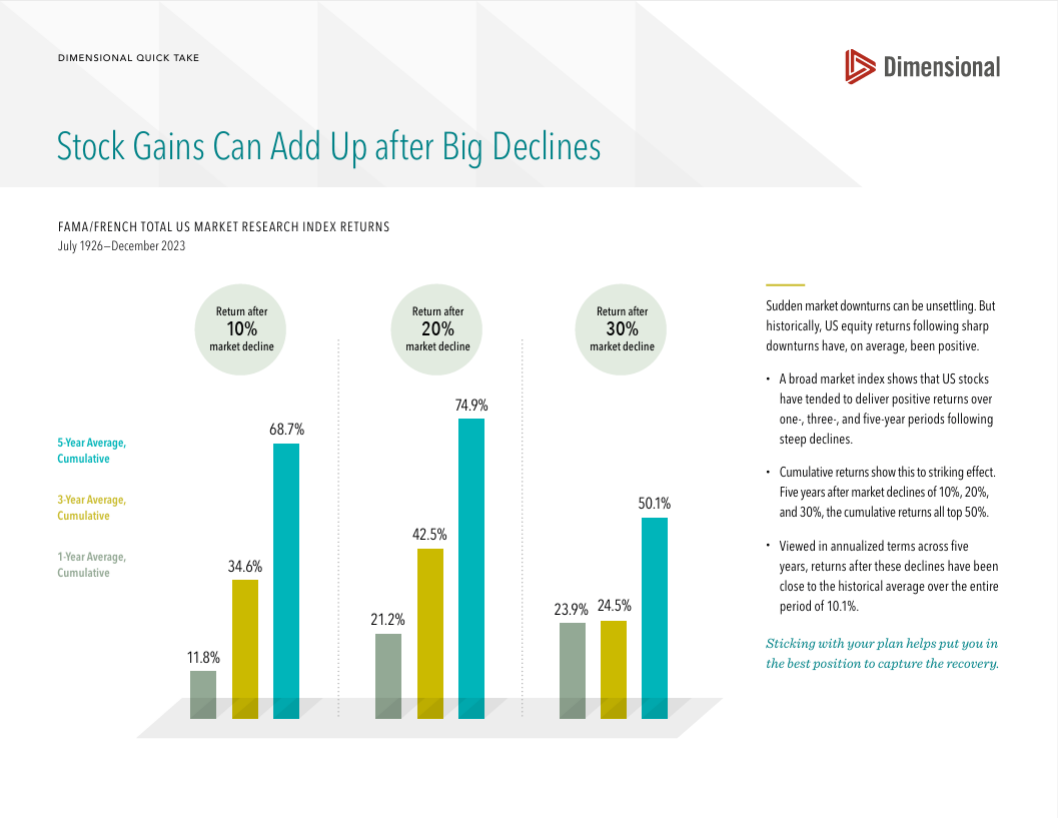

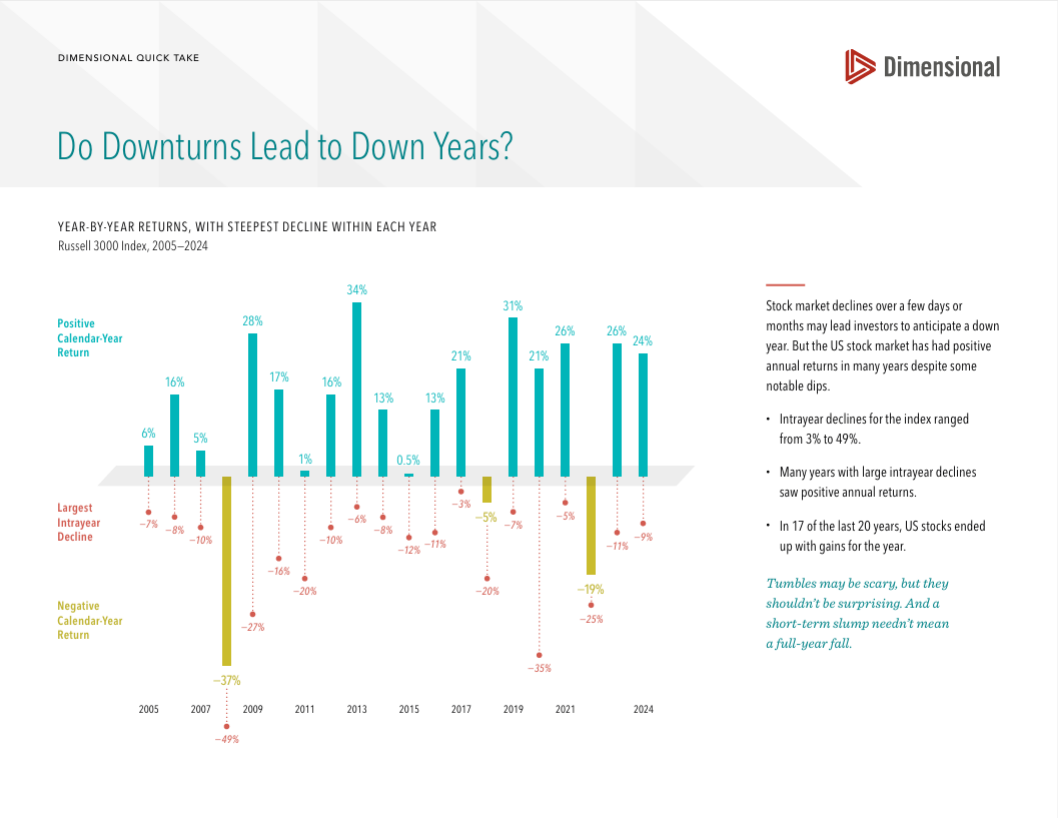

- Avoid panic selling. History shows that selling in a downturn is one of the costliest mistakes investors make. Market recoveries often follow downturns faster than we expect. Plus, the US stock market has delivered positive annual returns in many years despite sharp intra-year drops. (See the charts at the end of this letter for reference.)

- Consider tax-smart moves. If you plan to complete a Roth conversion this year, consider completing it now. Why? Say you want to convert $20,000 worth of shares. If those shares once traded at $100 but now sit at $80, you can convert more shares (250 vs. 200) for the same tax bill—or the same number of shares (200) and pay less in taxes. Either way, you benefit. If those shares recover later, that growth happens tax-free.

If you have a taxable portfolio, I will also be looking for tax-harvesting opportunities.

- Stick to your plan. We built your plan to weather both good markets and tough ones. Market downturns are part of the process—that’s why we accounted for uncertainty from the start.

- Stay patient. Tariff negotiations are still unfolding. We have no idea how this will play out, and history suggests that reacting prematurely often does more harm than good.

Keep Perspective

Just five years ago, during the early days of the COVID crisis, the S&P 500 declined 34% in just 23 days—the fastest such decline in history. Many investors panicked. Some sold. A year later, the market had rebounded 78% from its lowest point. (See chart below.)

At the time, it felt like the world might be ending. However, markets did what they’ve always done: declined, recovered, and eventually moved higher.

After nearly 40 years as a financial professional, I’ve learned two things:

- We can’t predict the future.

- Despite the uncertainty, markets have always recovered—eventually.

That doesn’t mean there are guarantees. But it does mean that reacting emotionally to short-term moves often leads to worse outcomes than simply staying the course.

If you’re feeling unsettled or just want to talk things through, I’m here. Just hit reply, and we’ll schedule a time to chat.

Your peace of mind is just as important as your portfolio and your financial plan. I’m always happy to listen.

Best,

Phil

Let’s Stay Grounded Together

Markets will always have ups and downs—but you don’t have to navigate them alone. Whether you’re feeling calm, uncertain, or somewhere in between, I’m here to listen, answer questions, and help keep your plan on track.

Need to talk about how your plan fits into this market? Schedule a call if you would like to chat.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

If you would like to speak with us about financial topics, including facing new beginnings, managing your investments, creating your life plan, or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Follow us:

Please note. We post information about articles that can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/