Advisory Services

At Apprise, we believe taxes and investing are joined at the hip. You should always consider taxes when investing. That doesn’t mean you have to let the tax tail wag the dog, but it does mean you shouldn’t overlook taxes. Good tax planning can reduce your tax bill. That leaves you more money to spend today or save for tomorrow. We maintain a focus on long-term gains and tax sensitivity.

We will apply principles of Asset Location – which assets belong in which account types from a tax perspective – to your portfolio. We also help you decide when to complete Roth conversions. We can help you allocate your workplace retirement savings between a 401k and a Roth 401k, when applicable. If you have a high-deductible healthcare plan, we will help you decide if a Health Savings Account is appropriate and how to use it most effectively.

While working, we focus on saving. When we retire, things change. Now we must determine the most efficient way to withdraw money from our retirement accounts. Not sure of the best withdrawal strategy? We will help you understand your options and what approach makes the most sense for your situation.

As part of our process, we will also review your tax return to look for tax planning ideas.

At Apprise Wealth Management, we take pride in being a trusted financial partner, especially for female-led households. Our mission is to enhance our clients’ financial lives as well as their understanding of financial concepts. We strive to deliver you with the holistic, customized guidance you deserve based on a foundation of trust and transparency. We strive to align people’s capital with what’s truly important.

Why Choose Us

INTEGRATED APPROACH

It is through detailed financial conversations encompassing all aspects of our clients’ lives that we empower people to make informed decisions.

ACCOUNTABILITY

PEACE OF MIND

At Apprise, we understand that short-term tactics can be important but they must be executed based upon wise strategic decisions rather than best-guess predictions.

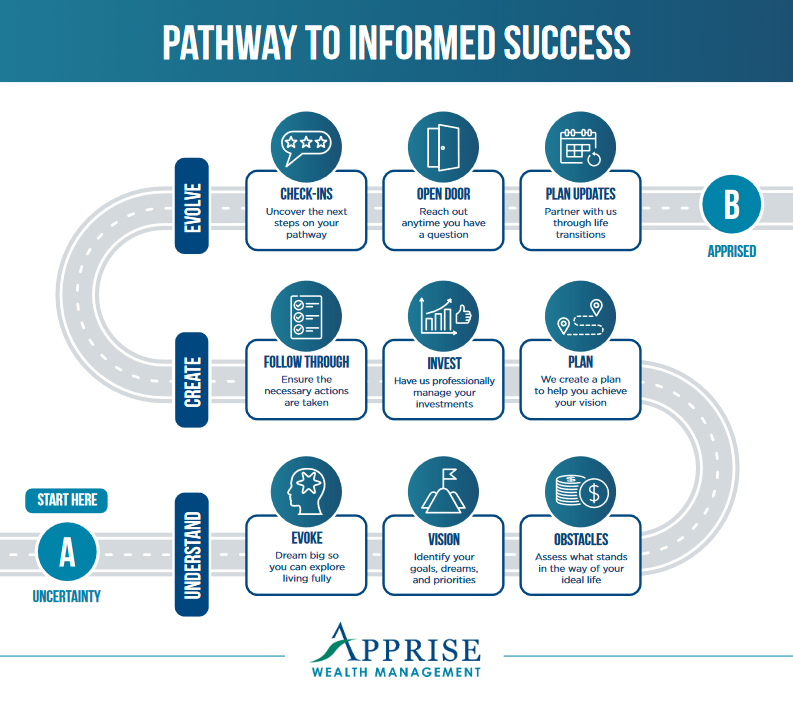

Pathway to Informed Success