In this week’s Tuesday Tip video, discover how to avoid the retirement tax trap no one talks about—especially if you’re widowed, divorced, or entering retirement alone. Please watch the video below, or read the transcript that follows, to learn more.

Today, I want to address the retirement tax trap no one talks about. It’s rarely discussed, but could quietly cost you thousands of dollars in retirement.

Hi, I’m Phil Weiss, CPA, CFA, and Registered Life Planner for Apprise Wealth Management. If you’re a woman navigating retirement after a major life change, like the loss of a spouse, divorce, or simply entering a new phase, you’ve likely been told to focus on your investments and spending.

The Retirement Tax Trap is something many women don’t see coming. Most people are unaware of its existence.

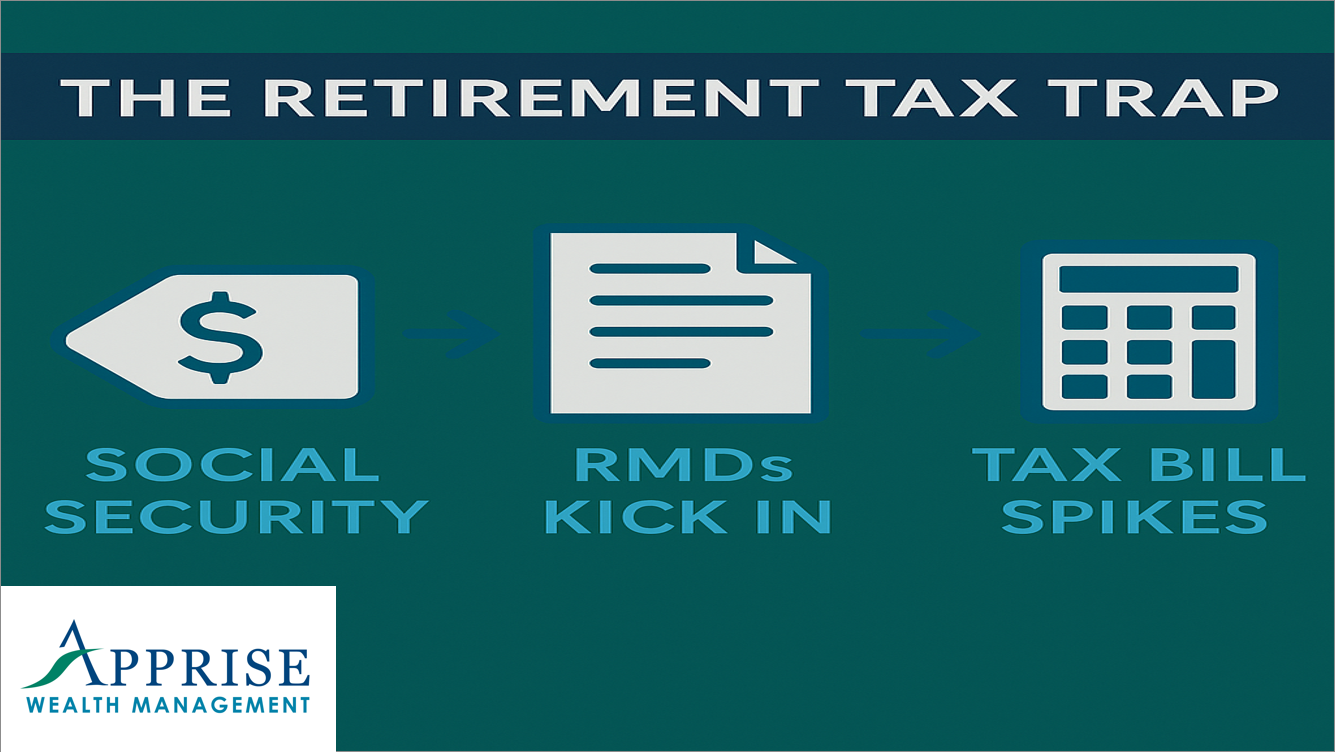

Here’s what it looks like:

You retire. You start collecting Social Security.

Required Minimum Distributions—or RMDs—kick in.

And suddenly, your tax bill spikes.

Why?

Because of how our tax system works, and because you may have more taxable income than you realize.

Many women I work with are surprised to learn that:

Up to 85% of your Social Security benefits can be taxed

RMDs from pre-tax accounts like IRAs can push you into a higher tax bracket

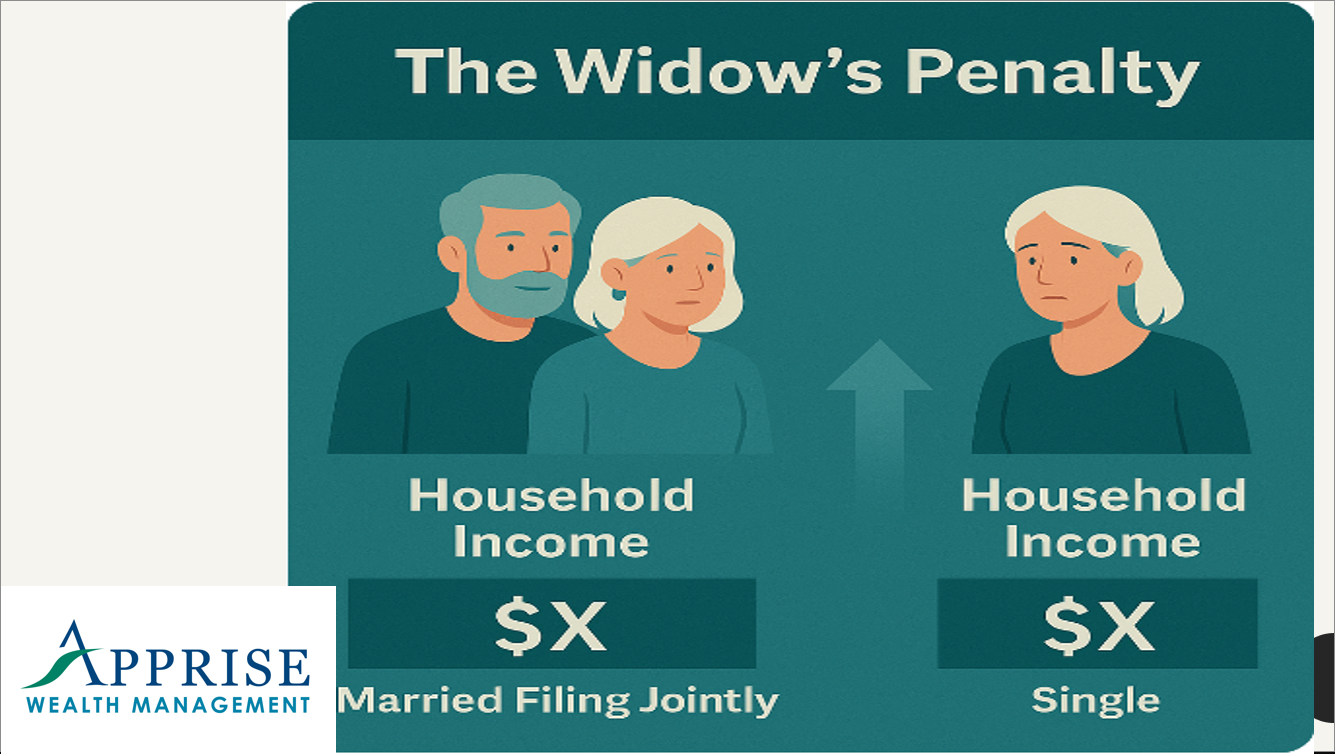

And if you’re widowed, you may shift from married filing jointly to single, triggering what we call the “widow’s penalty”—a higher tax rate on the same income.

Keep in mind that your income may not change as much as you think when you’re widowed. You will likely combine your spouse’s IRA with yours. You will lose the lower of your two Social Security benefits. Everything else could remain the same.

Let’s say you and your spouse used to file jointly. But you’re now filing as a single taxpayer.

That same income is suddenly taxed at a higher rate.

This can happen while you’re still grieving, making financial decisions feel even more overwhelming.

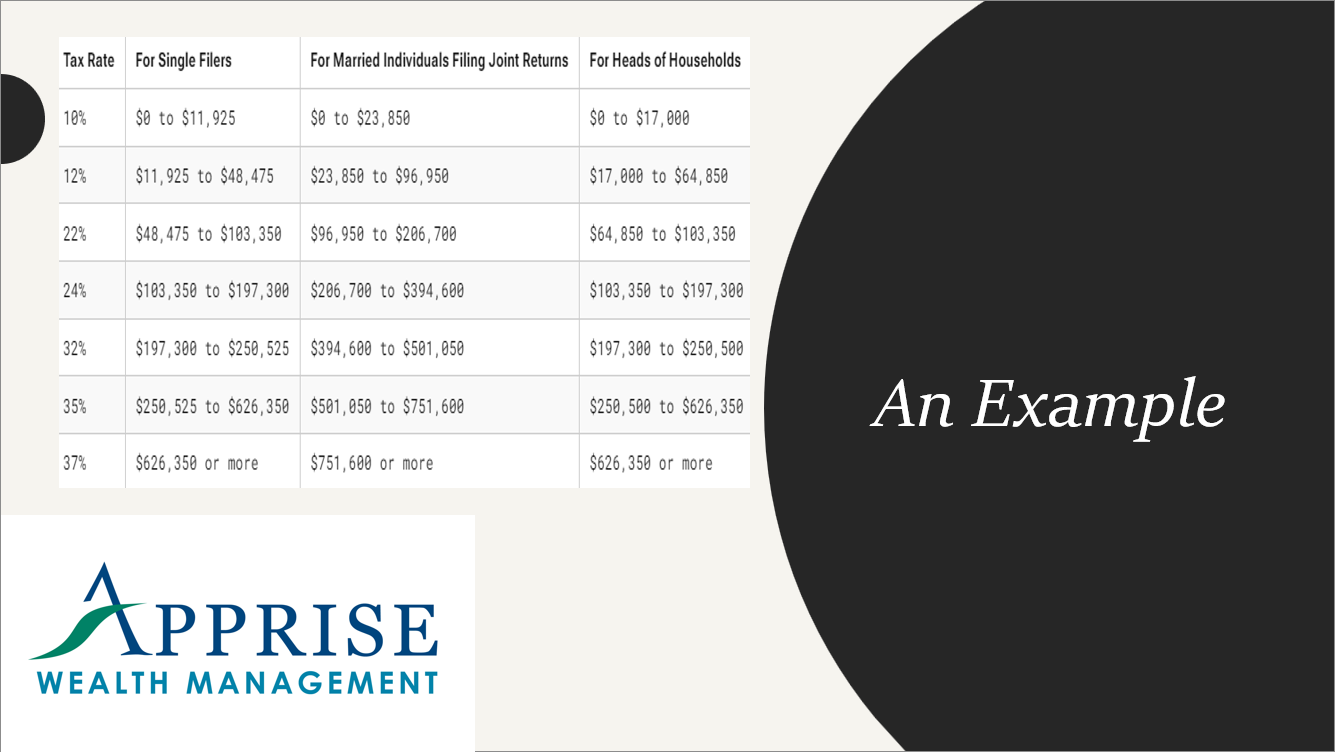

Here’s an example of what can happen. Last year, a client’s wife died. Up until then, we completed annual Roth conversions to fill the 12% tax bracket. We completed a Roth conversion in the year his wife passed because the IRS allows you to file married filing jointly in the year that you become a widow. But last year was the last year the 12% bracket would apply. For a married couple, the 12% bracket applies to taxable income up to $96,950. For someone who files as single, that limit is only $48,475. Now that he will file as a single taxpayer, his tax rate will be at least 22%.

But here’s the good news:

With proper planning, this retirement tax trap no one talks about can often be avoided—or at least minimized.

You can consider strategies like the following:

Roth conversions before RMDs start

Thoughtful Social Security claiming strategies

And tax-aware withdrawal planning

You can find more about the benefits of Roth conversions before RMDs start in my blog, How Roth Conversions Can Help You, Your Surviving Spouse, and Your Heirs.

These strategies can make a big difference, and they can be applied at any age. I work with clients who complete Roth conversions, ranging from their 20s to their 80s. It’s all about understanding what your future income could be and deciding on a tax rate that you feel comfortable with. Remember, your goal should be to pay the lowest amount of taxes you can during your lifetime, rather than paying as little as possible in a particular year. Focusing on the big picture can leave you with more money to spend now as well as in the future.

You don’t have to become a tax expert to avoid these pitfalls.

However, you do need a plan, especially if you’re entering retirement alone or navigating a major transition.

To learn more about the taxation of retirement income, you can also watch this video, Understanding Taxes and Your Retirement Income

At Apprise, I help women like you understand the whole picture—because tax planning is, in fact, retirement planning. If you’re not familiar with the retirement tax trap no one talks about, which I’ve discussed today, you should be. Failing to address it can cost you money.

If you’re wondering how to protect your income and keep more of what you’ve saved, let’s talk.

Click the link below to schedule a free introductory call.

Let’s help you avoid the retirement tax trap, so you can focus on living the life you truly want.

Thank you for listening. Have a great day.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

If you would like to speak with us about financial topics, including facing new beginnings, managing your investments, creating your life plan, or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Follow us:

Please note. We post information about articles that can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/