In this week’s Tuesday Tip video, discover key tax strategies for navigating taxes after a big life change. Learn about Social Security taxation, RMDs, and Roth conversions to create a confident plan.. Please watch the video below to learn more.

This week’s video blog addresses “Navigating Taxes After a Big Life Change: A Guide for Women Starting Fresh.

Hi, I’m Phil Weiss of Apprise Wealth Management. If you’re a woman navigating taxes after a big life change, whether it’s due to divorce, the loss of a spouse, or simply stepping into a new chapter, understanding your taxes can help you take back control and make more confident financial decisions.

In this video, we’ll cover three important areas:

- Social Security taxation

- Required Minimum Distributions, or RMDs

- Roth conversions

Let’s break it down together.

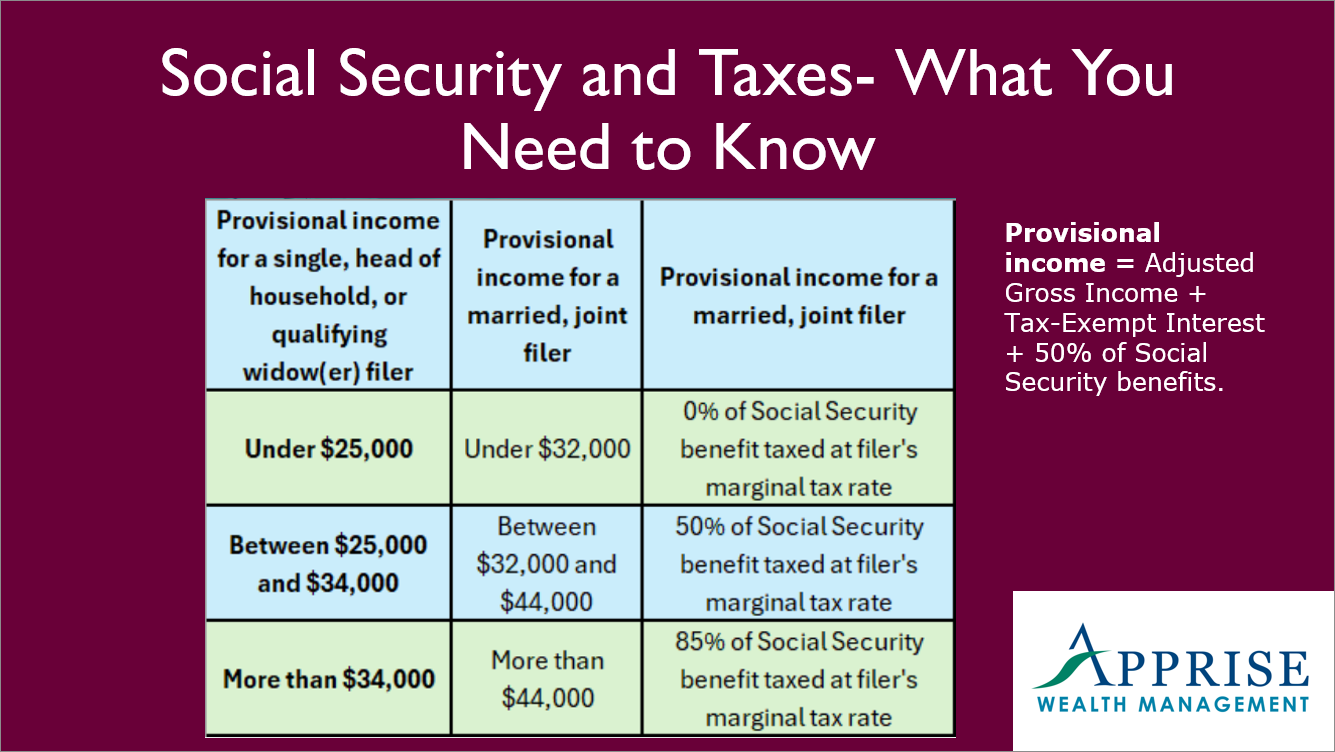

Did you know your Social Security benefits can be taxable?

Depending on your income, up to 85% of your benefits might be subject to federal income tax.

Here’s how it works:

The IRS uses something called your “provisional income” to determine taxation. Provisional income represents the sum of your adjusted gross income, any tax-exempt interest, and one-half of your Social Security benefits.

If you’re single and your provisional income is over $25,000, you’ll likely owe taxes on a portion of your benefits.

If you’re married filing jointly, that threshold jumps to $32,000.

This often catches people off guard, especially after a major transition when your income sources change. You also want to be wary of the Social Security Tax Torpedo. When your income is close to one of the provisional income thresholds, your tax rate could be abnormally high.

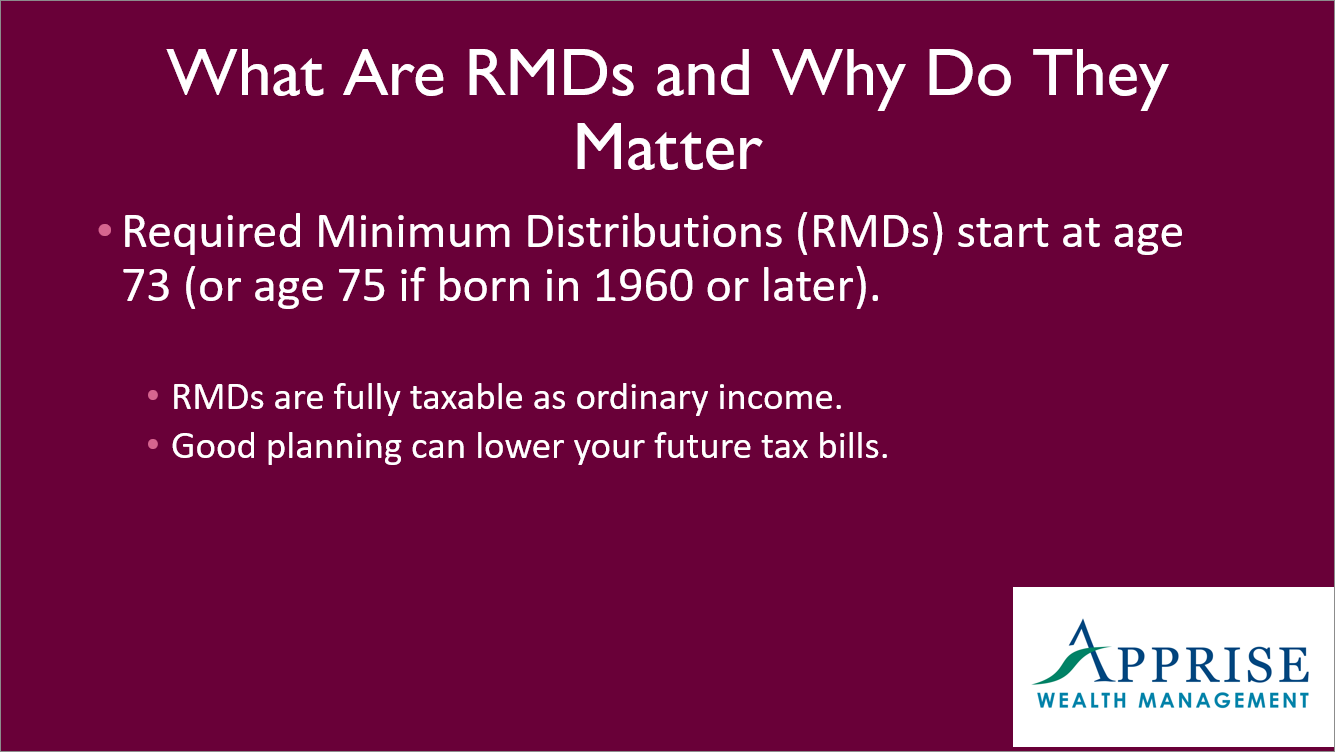

If you’ve saved in a traditional IRA or 401(k), you’ll eventually have to start taking Required Minimum Distributions—or RMDs—starting at age 73. The age for RMDs increases to 75 if you were born in 1960 or later.

Here’s why this matters: RMDs are fully taxable as ordinary income. So even if you don’t need the money, the IRS still wants its cut.

If you’re recently widowed or divorced, your filing status may shift from married filing jointly to single or head of household. This could cause your tax bracket to change, meaning you will now pay taxes on your withdrawals at a higher rate than you did when your filing status was married filing jointly.

This is what makes planning so important.

Roth conversions are one way to take control.

A Roth conversion lets you move money from a traditional IRA into a Roth IRA. You’ll pay taxes now, but future withdrawals will be tax-free, and Roth IRAs have no RMDs.

This can be especially powerful if your income is temporarily lower following a life transition. You might find yourself in a lower tax bracket, allowing you to convert at a reduced rate and minimize future RMDs. When it comes to taxes, you want to focus on paying the lowest amount of taxes over a period of years rather than in any single year.

Roth conversions can also help reduce or eliminate higher Medicare premiums due to IRMAA, or the Income-Related Monthly Adjustment Amount. As your income surpasses certain thresholds, you pay more for Medicare insurance. This issue is also addressed in “The Social Security Tax Torpedo: Could It Happen to You?”

Consider that Roth Conversions can help you, your surviving spouse, and your heirs.

A Roth conversion strategy may not be right for everyone, but it’s worth exploring with your advisor, especially if you’re early in retirement or recently single.

Let’s recap:

- Your Social Security could be taxed depending on your income

- RMDs are required starting at age 73—or age 75—and can create tax surprises

- Roth conversions may help reduce future taxes and give you more flexibility

- Roth conversions can help reduce the likelihood of paying higher Medicare premiums based on your income.

Navigating taxes after a big life change can feel overwhelming, especially if you’re starting fresh after a significant life change. But with the right plan, you can approach this next chapter with confidence.

At Apprise Wealth Management, we help women in transition take the next right step—financially and personally.

If you’d like to talk about your retirement tax strategy, schedule a free call with me. Let’s figure out how to turn uncertainty into opportunity.

Thanks for watching.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

If you would like to speak with us about financial topics, including facing new beginnings, managing your investments, creating your life plan, or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Follow us:

Please note. We post information about articles that can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/