In this week’s Tuesday Tip video, discover how elections influence the stock market and why focusing on long-term financial goals matters more than political shifts. Please watch the video below to learn more. If you would like a free review of your current financial situation, please use this link to schedule a free call. You can find an edited transcript below the video.

This week, I will discuss a topic at the top of many investors’ minds – elections and the stock market. Election results often spark concern about the stock market. We wonder what it means to our financial future and the country. Elections can stir strong emotions – whether your side won or lost. But as it relates to markets, history shows us that focusing on the long term is key.

Historically, economic fundamentals have influenced markets much more than which party is in power. Initially, the market responded positively to this year’s election outcome. Investors reacted positively to the potential for lower corporate tax rates and deregulation. Why? Both could benefit corporate earnings.

This week, the market dipped after comments from the Federal Reserve’s Chairman raised concerns about the future course of interest rates. The initial optimism for President Trump’s policies also waned.

What History Tells Us

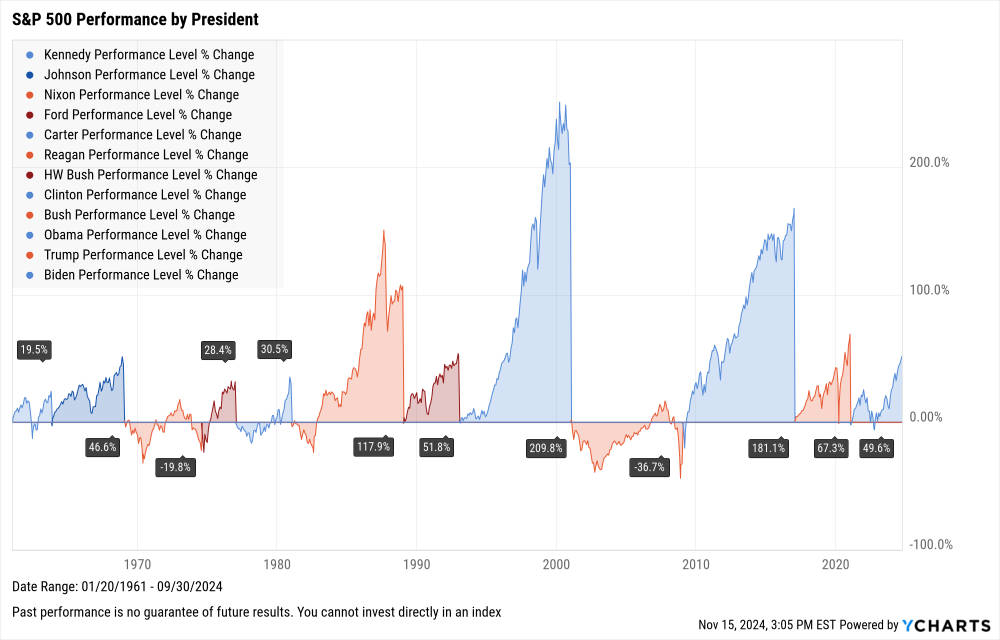

However, we don’t know what’s going to happen. While past performance does not guarantee future results, the S&P 500’s long-term growth remains steady despite short-term political shifts, as shown in the following chart. As you can see, since 1961, the S&P 500 has trended higher under most presidents, regardless of party. Only two presidents, Richard Nixon and George W. Bush, saw negative returns.

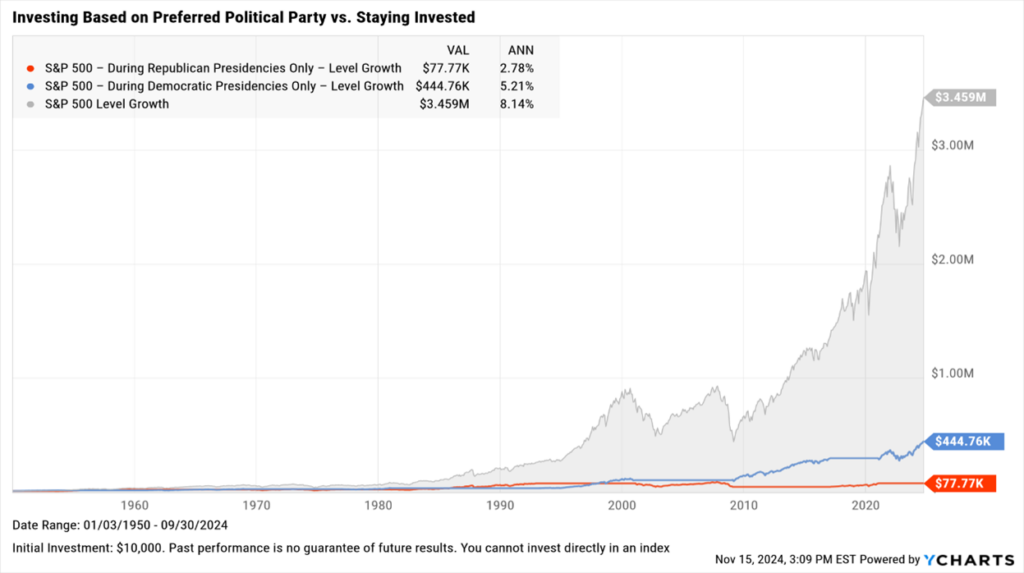

We can also take a different approach. What would happen if you only invested when your favorite party was in the Oval Office? Going back to 1950, the S&P 500 has grown during both Democratic and Republican presidencies. However, you would have fared best if you remained in the market throughout the period.

What Drives Long-Term Growth

A few factors contributed to the market’s solid long-term results:

- Long-Term Trends: These charts show the market’s long-term direction is up. This trend aligns with one of the reasons you invest. You expect the market to deliver long-term gains. If you didn’t, there would be no reason to invest. It would be better to keep your money under the mattress.

- Company Growth: While we occasionally experience recessions, the economy delivers long-term growth. This growth helps produce successful companies and has benefited economic strength under various administrations.

- Market Criteria: Factors such as earnings growth, the economy, and innovation help drive market performance – not politics.

- Investors: As investors, your strategy should align with our goals, time horizon, and risk tolerance. A single election matters far less when you maintain a long-term perspective.

Yes, elections have consequences. But you must maintain your perspective. Reacting too strongly to what happens in the short term could hurt you more than it could help you.

Elections and the Stock Market – Closing Thoughts

At Apprise, we monitor how political shifts might impact taxes, regulations, and corporate competitiveness. But we also know that short-term volatility often gives way to long-term growth.

For women navigating new beginnings, it’s especially important to focus on the big picture and not let short-term market shifts derail your long-term goals.” We recommend that you stay focused on your long-term financial goals. Work to align your TEAM of capital (Time, Energy, Attention, and Money) with your values. Doing so will help you live your most fulfilling life. We are here to guide you every step of the way.

If you have any questions or if there’s anything we can do to help, please feel free to contact us. We can discuss the potential impact of current events on your investments, your life plan, or anything else that matters to you and your finances.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above information valuable. If you would like to talk to us about financial topics including your life plan, your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or virtual meeting via Zoom.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/