Did you know that your retirement nest egg can benefit if you optimize your retirement savings? You may be asking yourself, “What does it mean to optimize your retirement savings?” In short, the idea refers to minimizing the lifetime taxes paid when first contributing and then withdrawing contributions to your retirement accounts. Remember that when saving for retirement, you have choices as to what type of account you can save in. There are four primary account types:

- Pre-tax contributions, taxable withdrawals e.g., IRAs and 401(k)’s

- After-tax contributions, tax-free withdrawals, e.g., Roth IRAs and Roth 401(k)’s

- Pre-tax contributions and tax-free withdrawals, e.g., Health Savings Accounts (HSAs)

- Taxable contributions and withdrawals, e.g., regular brokerage accounts

For more details related to how income in these different types of accounts gets taxed, please check this blog.

Taxable brokerage accounts are largely mentioned here to provide a complete picture of your options. HSAs are relevant if you participate in a high-deductible healthcare plan. The discussion in this week’s blog will focus on 401(k)’s and Roth 401(k)’s. I want to address the key considerations when it comes to deciding how to optimize your workplace retirement savings: should you save in a 401(k) or a Roth 401(k)?

Women facing new beginnings often ask which account should be used for retirement savings. Some ask this question for themselves. Others ask it for their children.

Saving for Retirement and Taxes

Saving for retirement serves as a crucial financial goal. For many Americans, a 401(k) plan represents the primary vehicle for achieving it. If you can optimize your retirement savings from a tax perspective, you can meaningfully reduce the amount of overall taxes paid on your retirement savings.

When it comes to contributing to your 401(k), one key decision you must make relates to whether to contribute on a pre-tax or after-tax basis. Both options come with advantages and disadvantages. The answer depends on your financial situation and goals. Your projected current and future tax rates play a role, too. The goal of this blog is to help you understand how to optimize your retirement savings and pay the least amount of taxes on them during your lifetime.

Understanding Pre-Tax Contributions

- Tax Deductions: If you make a pre-tax contribution, you don’t pay current income tax on the money you deposit. In other words, you deduct the amount you contribute from your taxable income in the year in which you make the contribution. As a result, you pay less in current income tax. This can potentially put more money in your pocket today.

- Immediate Savings: Since pre-tax contributions lower your taxable income, they reduce the amount of income tax you owe in the current year. This can result in an immediate financial benefit, especially when you are in a higher tax bracket.

- Tax-Deferred Growth: Investments in a traditional 401(k) or IRA grow tax-deferred. This means you won’t pay taxes on any gains until you withdraw the money in retirement. Your investments can, therefore, compound more effectively over time.

- Required Minimum Distributions (RMDs): The IRS eventually wants to collect taxes on tax-free deposits into a retirement account. As a result, under current rules, you generally must start taking minimum withdrawals (RMDs) from such accounts when you reach age 73. (Note that this age increases to 75 in 2033.)

Understanding After-Tax Contributions

- Tax-Free Withdrawals: When you make after-tax contributions in an account such as a Roth IRA or Roth 401(k), you get a different benefit. In this case, when you withdraw funds in retirement, your contributions and earnings are typically tax-free. This can lead to substantial tax advantages in retirement. But keep in mind that you will pay current taxes on the amount you contribute.

- Flexible withdrawals. When you have Roth accounts, you have more flexible withdrawal options in retirement. Since you already paid tax on the contributions, you can withdraw them at any time without paying additional taxes or penalties. If you follow the rules, you won’t have to pay tax on earnings in your Roth account either. You may pay taxes on earnings withdrawn before age 59 ½ or if the account is less than five years old. You should also note that when you do Roth conversions the five-year applies separately to each Roth conversion you complete. You also don’t have to take RMDs from Roth accounts.

- Tax Diversification: Contributing to both pre-tax and after-tax accounts helps you create a more diversified tax strategy for retirement. This can provide you with increased flexibility when it comes to managing your tax liability in retirement.

- Greater Flexibility for Your Heirs: Under the IRS’s current rules, you have 10 years to withdraw funds from an Inherited IRA or Roth IRA. Depending on your heirs’ tax bracket and income, they could pay considerably more in taxes when they withdraw money from an Inherited IRA. If they inherit money from a Roth IRA, they still have 10 years to withdraw the funds, but they can keep it in the Roth account for up to the full 10 years without having to worry about the tax implications of their withdrawals.

Factors to Consider When Choosing:

- Current Tax Bracket: Your current tax bracket plays a critical role in this decision. If you are in a high tax bracket now and expect to be in a lower one when you retire, pre-tax contributions may make more sense. But, if you anticipate being in a higher tax bracket during retirement (this happens more than many expect), Roth contributions may be the better choice.

- Time Horizon: Your investment horizon matters. If you have many years until retirement, the tax-deferred growth of pre-tax contributions could result in substantial savings. Conversely, if retirement is imminent, Roth contributions can provide tax-free income sooner. Remember, too, that the larger the anticipated difference in current and future tax rates, the more tax rates matter in this decision.

- Financial Goals: Don’t forget to keep your overall financial goals in mind when deciding what to do. If you want to minimize your current tax liability, pre-tax contributions may be more appealing. If tax-free income in retirement is a priority, Roth contributions could represent the better option.

- RMDs and Estate Planning: If you want to leave your retirement savings to heirs or avoid RMDs, a Roth 401(k) has distinct advantages relative to a 401(k).

- Employer Match: Historically, employer matching contributions have been applied to pre-tax contributions – or at least made to a pre-tax account. You should almost always take full advantage of this match. It represents free money for your retirement savings. Your employer also likely assumed you would take it when deciding how much to pay you, so you are leaving money on the table if you don’t at least enough earn the match. Please note that under SECURE Act 2.0, the rules around matching catch-up contributions for those 50 or older are changing. Due to employer pleas, the new rules requiring older, higher-paid 401(k) participants to make their contributions into Roth accounts have been postponed until 2026.

An Example

This can be a complicated issue. All I’ve done so far is highlight the differences between the options. But I haven’t addressed the key question. What’s that? How do you make a choice that best positions you to optimize your retirement savings?

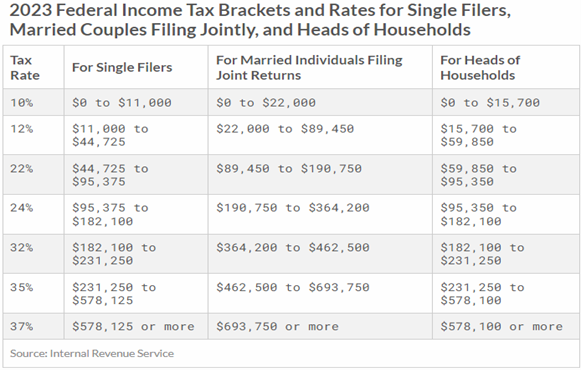

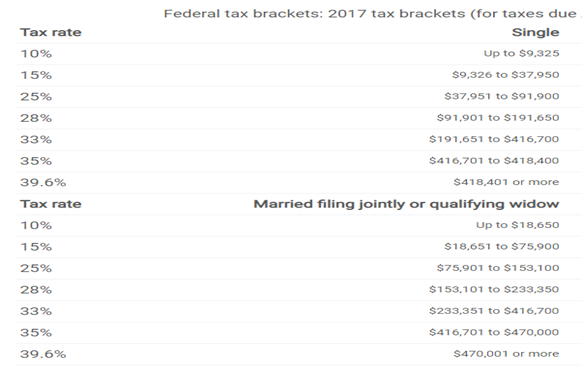

I have included this year’s tax table to help you understand the current tax rate structure. Absent future legislation, we will revert to the 2017 tax rates in 2026, as the current system is only in place through 2025. You can see that for many taxpayers, current rates are lower than they will be in 2026.

Following are some examples to help you better understand the thought process.

Early Career

Women facing new beginnings ask this question when they’re trying to help their kids decide which account to use for retirement savings when they start working. My son Daniel graduated from college this past May and recently started his first full-time job. We have discussed this issue.

Early in your career, your earnings are likely lower than they will be in the future. Many first-time hires will find themselves in the 12% or 22% tax bracket when they start working. A handful will be in the 24% bracket. If they are, it seems reasonable to assume their earnings – and tax bracket – will be much higher in the future. When earnings are low, contributing to a Roth 401(k) is typically the best course of action. You can save money that you haven’t paid much tax on, invest it, and let it grow for decades without having to pay taxes in the future.

Remember that you can withdraw contributions tax-free and penalty-free, if necessary, too. Say that your daughter has a starting salary of $80,000. Even after the standard deduction, she will only be in the 22% bracket when she has a full year’s worth of earnings. If she started in July, she might only earn $40,000 this year. Then she’d be in the 12% tax bracket. In the future, her income is likely to exceed $100,000 per year. That could put her in the 28% tax bracket. In this case, I would strongly consider saving in a Roth 401(k) rather than a regular 401(k).

Mid-Career

As your career progresses you should expect your earnings to increase. If you get married, you may get hit by the marriage penalty. If you look at the rates in the tables I shared, you will see that in 2023, up to a 32% tax rate, the income amount for each bracket doubles. The marriage penalty hits once you reach the 35% bracket. Under the 2017 tax rate system, the marriage penalty starts when rates reach 25%.

I consider a 24%/25% tax rate low, especially in a historical context. If you have a financial plan, I can also review what your income and tax rate might be in the future. In general, I almost always favor Roth contributions when your current rate is 24% or less. When I review client tax returns or discuss tax planning opportunities with clients, I also recommend Roth conversions to fill the 24% tax bracket.

When the current tax rate exceeds 24%, contributing to a conventional 401(k) could be the appropriate course of action. But not always. While it wasn’t for a 401(k) contribution, I was recently discussing whether a client should take distributions from her Inherited IRA this year. She and her husband are in the 32% bracket. But when I reviewed their financial plan, it looked likely that their future tax rate could be even higher than 32%. Plus, if she let too much money accumulate in her Inherited IRA without taking distributions, the estimated tax cost of future withdrawals could be even higher as she could have a large distribution in one or more years. Better to spread things out.

Late Career

Oftentimes, your income will be highest near the end of your career. Hopefully, you have been receiving promotions and raises along the way. That means higher income. You could easily find yourself in the 35%, or even 37% tax bracket. Under the pre-2018 system, your rate could be as high as 39.6%. If you have saved diligently and seen strong growth in your portfolio, it could still make sense to contribute to a Roth 401(k). But for most, your best option will likely be to save in your regular 401(k) when you reach this point.

In some cases, a mixed approach can also make sense. You could split your contributions between your regular 401(k) and your Roth 401(k). As noted above, beginning in 2026, catch-up contributions for high earners who are 50 or over must be made to a Roth 401(k). This was one of the revenue-raising provisions of SECURE Act 2.0.

Recommendation Summary

In general, I typically think of it this way. If you are in the 24% tax bracket or less, I favor making after-tax contributions to a Roth account. On the other hand, if you are in the 35% tax bracket or higher, I favor making pre-tax contributions to a conventional 401(k). I want to take a closer look at the current and projected tax situation of those who are in the 32% tax bracket before recommending pre-tax or after-tax contributions.

Roth Conversions

As noted above, Apprise offers to review client tax returns. Roth conversions are typically recommended for most mid-career or earlier clients who are currently in the 22% or 24% tax bracket. These rates look low from a historical perspective. Many of these clients also have meaningful balances in their retirement accounts already. Based on what we know today, their tax rate in retirement is likely to be higher than 24%.

Final Thoughts About How to Optimize Your Retirement Savings

Deciding between pre-tax and after-tax contributions to your 401(k) is a significant financial decision with long-term implications. Unfortunately, you won’t find a one-size-fits-all answer. The right choice depends on your circumstances and financial goals. In many cases, a combination of both pre-tax and after-tax contributions can provide a balanced approach that addresses both immediate and future tax considerations. Consulting with a financial advisor can also be invaluable in making this important decision. A financial advisor can help you create a retirement savings strategy that aligns with your unique financial situation. Ultimately, the key is to save consistently and make choices that align with your vision of a comfortable and secure retirement. If you would like to discuss your situation, please schedule a free call. We would be happy to discuss your situation in more detail.

If you would like to talk to us about financial topics including your investments, creating your life plan, saving for college, or saving for retirement, please complete our contact form or schedule a call or a virtual meeting via Zoom. We will be in touch.

Next week, please look for our Tuesday Tips video blog.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

Follow us:

Please note. We post information about articles we think can help you make better money-related decisions on Facebook and LinkedIn.

For firm disclosures, see here: https://apprisewealth.com/disclosures/