If you have aging parents, you may need to take care of them – or help arrange for their care in the future. Helping prepare your parents to age well and providing caregiving support can have benefits. It can keep them healthier and more active. It can also provide sustainable, long-term health and care benefits.

Whether you have kids of your own, or you’re an empty nester, if your parents are still alive, you should consider their future care. Why? Life expectancy continues to rise. The prevalence of caregiving does, too.

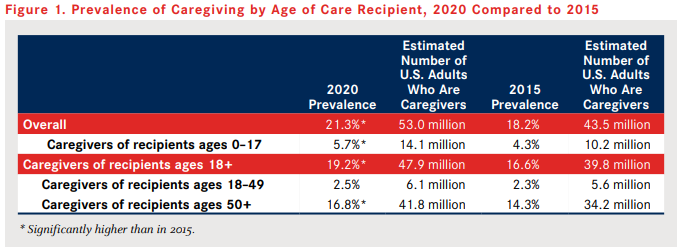

According to this AARP research report on caregiving in the U.S. in 2020, more than 1 in 5 Americans (21.3 percent) are caregivers. This means they have provided care to an adult or a child with special needs at some time in the past 12 months. This equates to an estimated 53.0 million adults in the U.S., up from the estimated 43.5 million caregivers in 2015.

Most of this growth relates to those providing care for adults 50 and over. In this group, the prevalence of caregiving has risen from 16.6% in 2015 to 19.2% in 2020. More than 8 million adults provided care to a family member or friend age 18 or older in 2020 than 2015. Significantly more adults cared for a family member or friend who is age 50 or older during this period.

The cost of care can be expensive, too. Alzheimer’s is one of the drivers of the need for care. In 2020, more than 11 million Americans provided unpaid care for people with Alzheimer’s or other dementias. These caregivers provided more than 15.3 billion hours of care. The estimated value was nearly $257 billion.

Providing such care can be challenging. Many caregivers (about 12%) have children of their own. This leaves them trying to balance two challenging roles. We may love our parents, but we are not experienced caregivers. Assuming this vital role involves a steep learning curve. It’s unlikely that you will immediately know how to meet the many needs of your aging parents.

This week’s checklist can help you protect your parents and maximize your caregiving efforts.

Getting Started

They often say that attitude makes a difference. Help your parents understand the impact their lifestyle choices can have. Factors such as activity levels, healthier eating, and positive thinking matter. They can help your parents take better advantage of senior living services and the available resources.

Personal Information

You must have your parent’s personal information. This includes the following:

· Full name

· Date of Birth

· Social Security Number

· Phone Number and Address, including legal state of residence

· Marital Status

· Health Status

· Names and Phone Numbers for your parent’s doctor, attorney, geriatric care manager, and other important persons

· Phone Numbers for family members and your parent’s closest friends

Finances

You also want to understand your parent’s financial situation and data:

· Income sources (Social Security, pension, dividends, annuities, required minimum distributions, current employment (if applicable), etc.).

· Monthly and yearly expenses.

· Assets (what they own).

· Liabilities (what they owe).

· Financial Advisor (if applicable).

· Bank, investment, credit card, and other financial accounts – this includes knowing (or knowing where to find) any login information).

· Become an authorized user on your parents’ accounts if they can no longer manage their own money. This allows you to pay bills on their behalf.

· You can also consider a power of attorney for finances.

Estate Planning and Legal Issues

· If your parents have a will, is it up to date?

· Do your parents have a living will? Do you know their position on DNR?

· Are advanced directives prepared, including durable power of attorney?

· Have your parents designated beneficiaries on their financial accounts (can help avoid probate)?

· If your parents’ assets are subject to estate tax, have you spoken with an attorney about how to minimize these costs?

· Have you discussed funeral arrangements and other end-of-life decisions?

· Have your parents prepared proper letters of instruction?

Health and Medical Support

An understanding your parents’ health and medical needs is an important part of any caregiving plan. Work with your parents on the following items:

· Complete paperwork at each medical provider’s office that allows you to view and discuss your parent’s medical records.

· Attend medical appointments with your parents, especially for diagnostic testing.

· Help your parents manage any prescription refills. Take advantage of any autofill options. An automatic pill dispenser can also help them manage their daily medication regimen.

· Make sure there is a healthcare power of attorney.

· Understand your parents’ insurance coverage:

· Long-term care insurance, if applicable

· Life insurance, if applicable

· Health insurance coverage

· Auto insurance

· Homeowner’s insurance

· Umbrella insurance

Exercise and Nutrition

Nutrition is the key to healthy aging. If your parents are not eating well, consider services such as Meals-on-Wheels or having their grocery shopping and meal prep done for them. Having healthy, easy-to-prepare meals and snacks on hand can improve their health and energy level.

You also want to encourage your parents to exercise regularly. This can include walking, swimming, taking senior-specific exercise classes, golfing, or other activities that can help them maintain their strength, stamina, and balance.

If your parents’ mobility has declined, make sure they have the necessary modifications to remain active, including:

· Mobility aids.

· Exercise bands/home exercise equipment.

· Ideas for exercising from a wheelchair or chair (for example).

Housing

If our parents still live in their own home, you want to consider the following:

· Preparing a repair and maintenance checklist.

· If they have difficulty going up and down steps, is first floor living possible. Are doors wide enough to accommodate a wheelchair, if necessary?

· If they need to move, make sure you understand their preferences and help them find suitable accommodations.

· Do your parents need home or skilled nursing care?

· Should your parents consider adult day care?

Transportation

At some point, most seniors must modify their driving activities. For example, their driving can be restricted to daylight and good weather. They may even have to turn in their keys. This plays an important role in their aging process because of the effect it can have on social engagement and community activities. These are essential to their emotional and mental wellbeing. AARP created this free online seminar, We Need to Talk. It will help you determine how to assess your loved ones’ driving skills and provide tools to help you have this important conversation.

Don’t Forget to Take Care of Yourself

Taking care of an aging parent can be time consuming and emotionally difficult, especially if your loved one’s health is declining. You should establish boundaries to what you can and cannot do. You don’t want to overextend yourself. If you cannot be the primary caregiver or are unable to perform certain tasks, ask for help.

You also need to establish boundaries. Sometimes you have to say no or reinforce your boundaries.

You also should make sure to set aside some time for yourself. Being constantly on the go can run you down and deplete your energy. You don’t want to overextend yourself, feel overworked, or under-appreciated. Before that happens, set aside some time for yourself. Go for a walk. Schedule a weekend away. Do what you need to do to recharge your batteries.

Closing Thoughts and What’s Next

Many of us are living longer. Depending on our health, we may need help. Oftentimes, children find themselves having to take care of aging parents. If you must (or want to) take care of your aging parents, there are many things you should keep in mind. This checklist provides things to consider if you must take care of your parents. You will also find links throughout the blog to other resources that can help.

May is “Caring for Aging Parents” month at Apprise. Besides today’s blog, it will also be the subject of our blog two weeks from now. This month’s “Ask Me Anything” webinar session will focus on this topic, too. If you have any questions about this week’s blog, other related issues we have not addressed, or would like greater clarification about any of the topics discussed, please join us for this month’s webinar. We will share additional information including registration information soon. We will host the event on Thursday, May 27th at 5 pm.

In the meantime, if you have any questions, please send an email to philweiss@apprisewealth.com or schedule a free call.

Our practice continues to benefit from referrals from our clients and friends. Thank you for your trust and confidence.

We hope you find the above information valuable. If you would like to talk to us about financial topics including your investments, creating a financial plan, saving for college, or saving for retirement, please complete our contact form. We will be in touch. You can also schedule a call or a virtual meeting via Zoom.

Please note. We post information about articles we think can help you make better money-related decisions on LinkedIn and Facebook.

For firm disclosures, see here: https://apprisewealth.com/disclosures/